However, in several circumstances, a longer statute of limitation may apply to a taxpayer. Once the tax practitioner has determined which records to retain, the next logical how long to keep accounting records question is how long the records should be retained. While there is a strong professional rationale for keeping records, the records should not be maintained indefinitely. Several costs are involved in maintaining the records, including those for storage and for ensuring data security. When the tax practitioner is also an electronic return originator (ERO), there are additional record-retention requirements. For instance, an ERO must keep the signed copy of Forms 8453, U.S.

Federal record retention guidelines: Who regulates record keeping?

It is self-balancing because you record every transaction as a debit entry in one account and as a credit entry in another. If your checkbook and journal entries still disagree, then refigure the running balance in your checkbook to make sure additions and subtractions are correct. After checking your figures, the result should agree with your checkbook balance at the end of the month. If the result does not agree, you may have made an error in recording a check or deposit. A ledger is a book that contains the totals from all of your journals. If you use the standard mileage rate for a car you lease, you must choose to use it for the entire lease period (including renewals).

- And when the files are no longer needed, a record retention policy can detail how to dispose of accounting records properly.

- Your accountant or tax advisor may have different recommendations for your situation.

- As discussed earlier, several Code sections require a tax preparer to retain the records for at least three years.

- Go to IRS.gov/Coronavirus for links to information on the impact of the coronavirus, as well as tax relief available for individuals and families, small and large businesses, and tax-exempt organizations.

Period of limitations that apply to income tax returns

- The records should substantiate both your income and expenses.

- The length of time you should keep a document depends on the action, expense, or event which the document records.

- The guidelines may vary depending on your industry and circumstances.

- First, you must distinguish between accounting records and accounting data.

- If you end up needing to go back to verify anything, see if you can access past bills through online account access.

- A partnership is the relationship existing between two or more persons who join to carry on a trade or business.

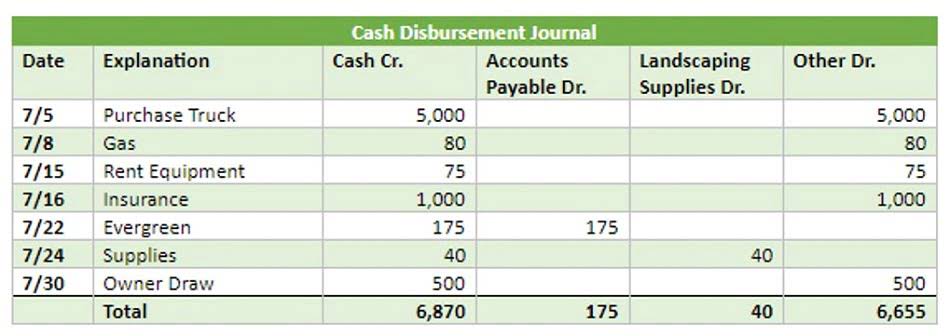

Table 3 contains the periods of limitations that apply to income tax returns. For example, under Sec. 6501(e)(1)(A) (ii), the statute of limitation is doubled to six years if more than $5,000 of foreign income is not reported. The IRS can look back seven years relative https://www.bookstime.com/bookkeeping-services/vancouver to a loss on worthless securities or a bad debt deduction (Sec. 6511(d)(1)). Additionally, states may have a different and possibly longer statute of limitation that should be taken into consideration when determining the appropriate retention period. Purchases, sales, payroll, and other transactions you have in your business generate supporting documents. These documents contain information you need to record in your books.

How long do you have to keep business records if the business closes?

And when the files are no longer needed, a record retention policy can detail how to dispose of accounting records properly. Member-prepared records and the member’s work product may be withheld in certain circumstances, such as if fees are due, as detailed further on in the section. It is critical to note that the member is not required to provide the client with their working papers (subject to federal and state laws and contractual agreements that may impose additional requirements). As a best practice, it is recommended that tax practitioners create and maintain a written document-retention policy.

A financial life necessarily involves a significant amount of documentation—from monthly bank statements to insurance documents to the various materials required to file your taxes. By learning what needs to stay and what’s free to go, you can minimize the amount of materials you accumulate over time. You will need to keep accounting records to support day to day business functions such as billing. Without keeping accurate records, you may not be able to correctly identify accounts receivable or accounts payable which can affect business cash flow. While this does not fall under any accounting records retention guidelines, it is more of advised good practice guideline. If you have employees, you must keep all employment tax records for at least 4 years after the date the tax becomes due or is paid, whichever is later.

Specific Documents

Your go-to source for tax developments and professional insights. Tap https://www.instagram.com/bookstime_inc into expert guidance, tools, news, and career development. Keep in mind that what follows is just general guidance and not necessarily the final word. Your accountant or tax advisor may have different recommendations for your situation.

If you file a claim for a loss from worthless securities, then the statute of limitations on an audit increases to seven years. Keeping these records will reduce the capital gains on the sale and reduce the tax you will owe. TAS is an independent organization within the IRS that helps taxpayers and protects taxpayer rights. Their job is to ensure that every taxpayer is treated fairly and that you know and understand your rights under the Taxpayer Bill of Rights. Multilingual assistance, provided by the IRS, is available at Taxpayer Assistance Centers (TACs) and other IRS offices.

- Keep records relating to property until the period of limitations expires for the year in which you dispose of the property in a taxable disposition.

- He does not need to adjust the Monthly Summary of Cash Receipts because he correctly entered the January 8 deposit of $600.40 in that record.

- This strategy simplifies the retrieval process when these records are needed.

- Financial statements include income statements, balance sheets, cash flow statements, and your company’s statement of retained earnings.

- Go to IRS.gov/SocialMedia to see the various social media tools the IRS uses to share the latest information on tax changes, scam alerts, initiatives, products, and services.

- The Internal Revenue Service has established some basic record-keeping rules for tax documents.

Business use of your home

Eight in 10 taxpayers use direct deposit to receive their refunds. The IRS issues more than 90% of refunds in less than 21 days. Each time you make a payment from this fund, you should make out a petty cash slip and attach it to your receipt as proof of payment..

Bidding farewell to US citizenship: Understanding the exit tax

Rosenberg Chesnov CPAs remains a licensed independent CPA firm that provides audit and other attest services to clients. These leased individuals will be under the direct control and supervision of Rosenberg Chesnov CPAs, which is solely responsible for the professional performance of audit and attest engagements. The fastest way to receive a tax refund is to file electronically and choose direct deposit, which securely and electronically transfers your refund directly into your financial account. Direct deposit also avoids the possibility that your check could be lost, stolen, or returned undeliverable to the IRS.